Understanding the VIX: The Market's Fear Gauge and Its Recent Surge

The VIX, also known as the "fear gauge," has been making headlines lately with its significant surge of 158% in recent times. But what exactly is the VIX, and why is it considered a crucial indicator of market sentiment? In this article, we'll delve into the world of the VIX, its significance, and the reasons behind its recent uptrend.

What is the VIX?

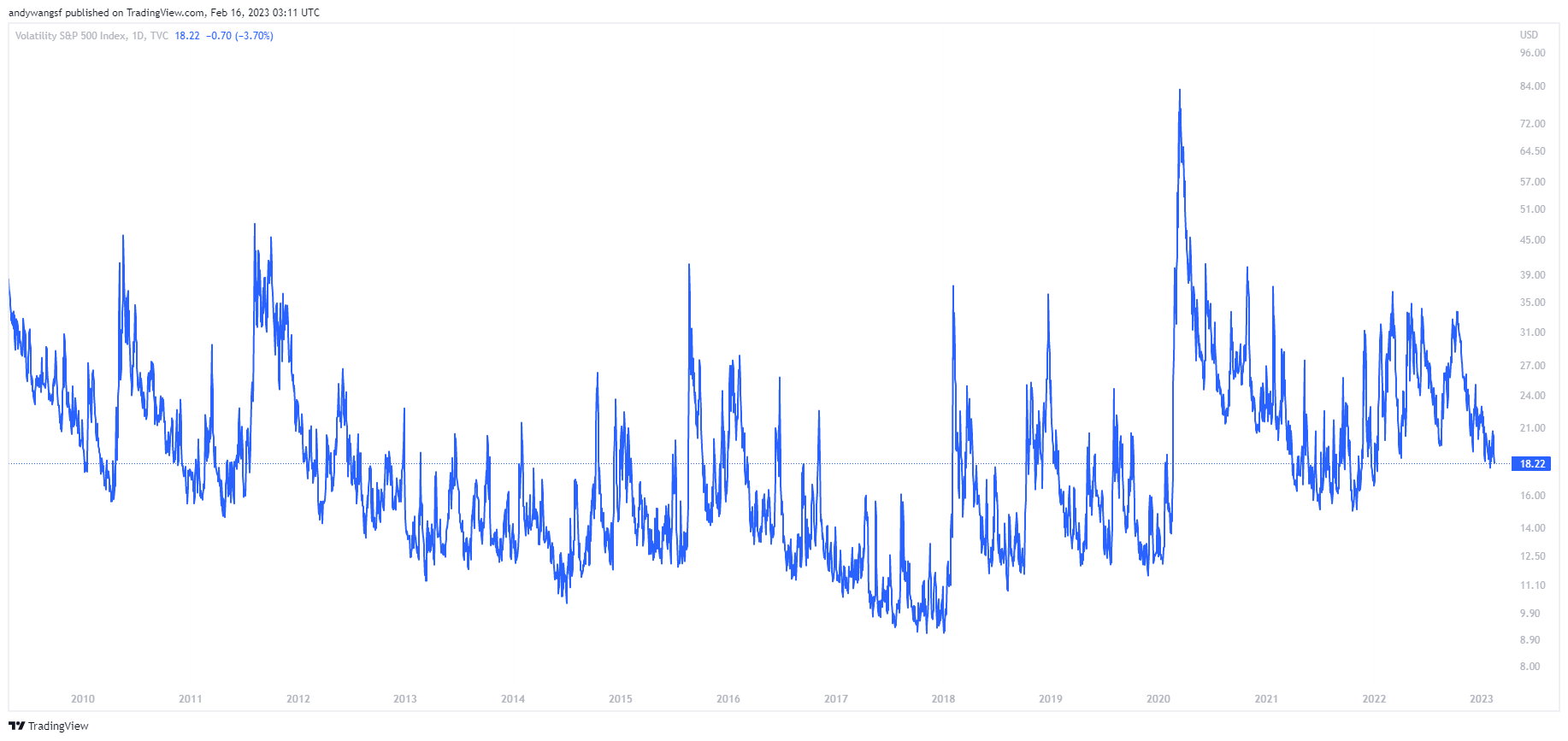

The VIX, or the CBOE Volatility Index, is a benchmark index created by the Chicago Board Options Exchange (CBOE) to measure the expected volatility of the S&P 500 Index over the next 30 days. It's calculated based on the prices of call and put options on the S&P 500, which reflect the market's expectations of future volatility. The VIX is often referred to as the "fear gauge" because it tends to rise when investors are uncertain or fearful about the market's direction.

How Does the VIX Work?

The VIX is calculated using a complex formula that takes into account the prices of various call and put options on the S&P 500. The index is designed to reflect the market's expectations of future volatility, rather than the actual volatility of the market. When the VIX is high, it indicates that investors expect the market to be more volatile in the near future, and when it's low, it suggests that investors expect the market to be less volatile.

Why is the VIX Up 158%?

The recent surge in the VIX can be attributed to various factors, including:

Economic uncertainty: The ongoing COVID-19 pandemic, trade tensions, and geopolitical conflicts have created a sense of uncertainty among investors, leading to increased volatility expectations.

Market fluctuations: The rapid fluctuations in the stock market, particularly in the technology sector, have contributed to the rise in the VIX.

Investor sentiment: The VIX is also influenced by investor sentiment, which has been bearish in recent times, leading to increased demand for protection against potential losses.

What Does the VIX Surge Mean for Investors?

The surge in the VIX has significant implications for investors. A high VIX can indicate that investors are becoming more risk-averse, which can lead to a decrease in stock prices. On the other hand, a high VIX can also present opportunities for investors to buy options or other volatility-related products to hedge against potential losses.

The VIX is a crucial indicator of market sentiment, and its recent surge is a reflection of the uncertainty and fear that pervades the market. Understanding the VIX and its significance can help investors make informed decisions and navigate the complex world of finance. As the market continues to evolve, it's essential to keep a close eye on the VIX and its implications for investors.

By monitoring the VIX and staying up-to-date with market trends, investors can better position themselves for success in the ever-changing world of finance. Whether you're a seasoned investor or just starting out, understanding the VIX and its role in the market can help you make more informed decisions and achieve your financial goals.

Keyword density: VIX (7), fear gauge (2), market sentiment (2), volatility (4), investors (5), stock market (2), economic uncertainty (1), COVID-19 (1), trade tensions (1), geopolitical conflicts (1).

Meta description: Learn about the VIX, the market's fear gauge, and its recent surge of 158%. Understand the significance of the VIX and its implications for investors.

Header tags: H1, H2, H3, H4, H5, H6.

Image optimization: Use images related to the VIX, stock market, and investing, with alt tags and descriptions that include target keywords.

Internal linking: Link to other relevant articles on investing, stock market, and personal finance.

External linking: Link to credible sources, such as the CBOE website, to provide additional information on the VIX.